Introduction Paying income tax is your duty, but does it always have to feel like a burden? Absolutely not! With the right strategies, you can legally reduce your tax liability and keep more of your hard-earned money in your pocket. Think of tax planning as gardening—if you plant the right seeds (investments and deductions), you’ll reap healthy savings at the end of the year. In this guide, we’ll explore how to save income tax in India in 2025 under both the old tax regime and the new tax regime. We’ll…

Month: October 2025

What is Advance Tax? Deduction Process, Liability, and Penalties Explained

Introduction 1. Understanding Advance Tax Advance Tax, often called “Pay As You Earn”, is a way to pay your income tax in parts instead of a lump sum. Therefore, you don’t need to wait until the end of the financial year to clear your tax bill. In other words, it’s like paying your tuition fees in instalments rather than struggling to pay them all at once. Moreover, Advance Tax applies when your net tax liability after deductions and TDS is above ₹10,000. Thus, if your annual liability crosses this threshold,…

7 New Income Tax Rules From FY 2025-26 For Salaried Employees | With Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from F.Y.2000-01 to F.Y.2025-26

Introduction The Union Budget 2025 has brought in some big updates for salaried employees that will take effect from April 1, 2025. These changes are meant to simplify the tax system, provide relief, and help employees plan their finances better. Think of it like getting a new set of tools in your financial toolkit—you can build your tax-saving strategy more effectively if you know how to use them. In this article, we will unpack the 7 New Income Tax Rules as per Budget 2025 in a simple, easy-to-understand way. You…

Benefits of New Tax Regime and Loss for Old Tax Regime: Brief Discussion as per the Budget 2025 | Check your Tax, Which is Beneficial for You by the Automatic Income Tax Calculator All in One in Excel for the F.Y.2025-26

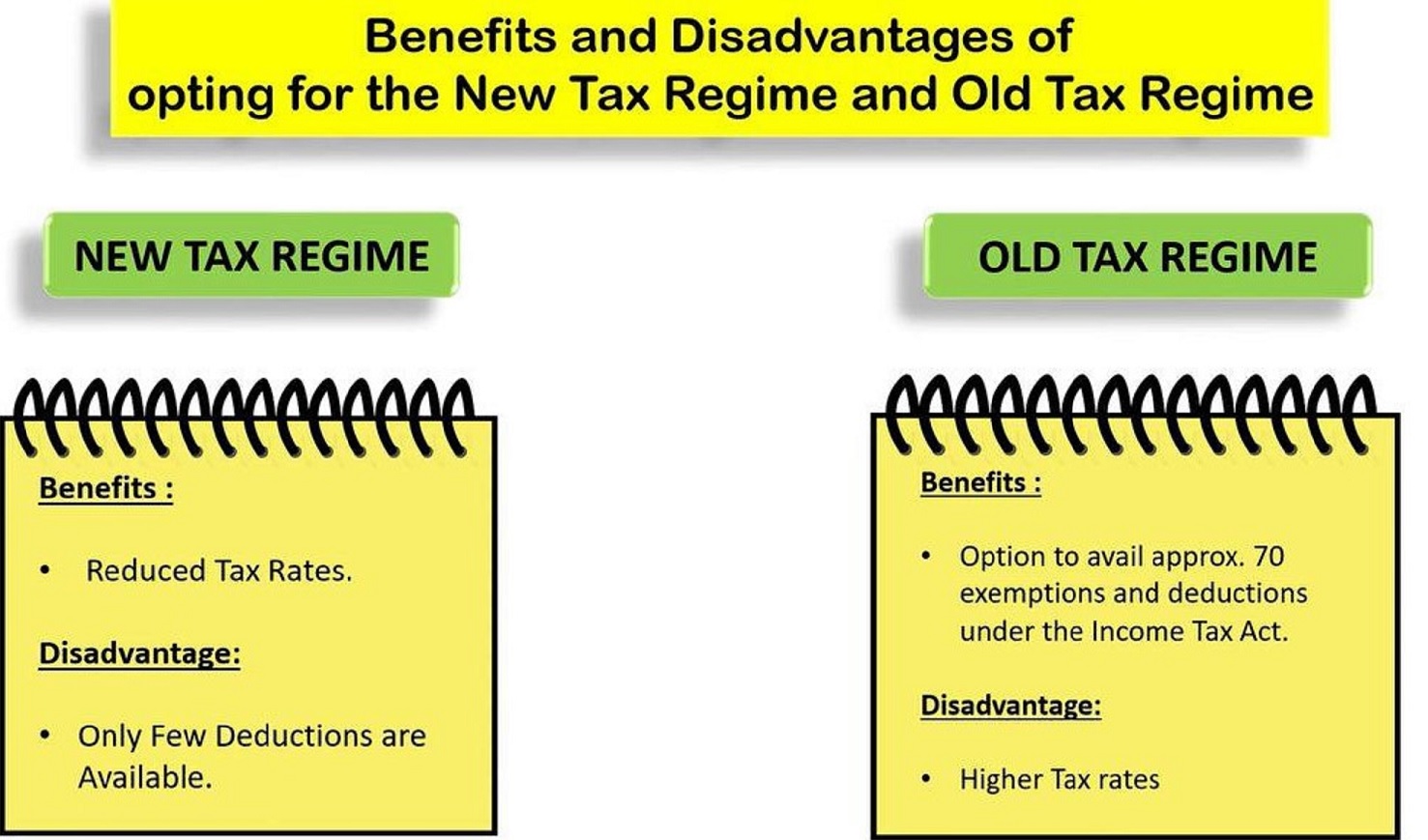

Have you ever wondered which tax regime saves you more money—the new or the old? As the Union Budget 2025 reshaped tax rules, taxpayers across India are debating this crucial question. While the New Tax Regime for FY 2025-26 offers simplified rates and fewer deductions, the Old Regime still appeals to those who rely heavily on exemptions and investments. To make the choice easier, an Automatic Income Tax Calculator, all-in-one in Excel, helps you quickly compare and decide what’s beneficial for you. Think of it like choosing between two different…

How to Decide Which Tax Regime Will Be Perfect for a Taxpayer for the F.Y.2025-26 | You can Check Your Tax Burden by this Automatic Income Tax Calculator F.Y.2025-26

Choosing the best tax regime for the Financial Year 2025-26 is one of the most important financial decisions for every taxpayer. Since the Government of India has introduced both the Old Tax Regime with deductions and the New Tax Regime with lower slab rates, taxpayers now have more flexibility. However, this flexibility also creates confusion. Many salaried employees, pensioners, and professionals ask the same question: Which tax regime will be more beneficial for me in FY 2025-26? Therefore, to answer this, you need to compare both regimes carefully. In addition,…

Income Tax Calculator All in One for All Salaried Persons for FY 2025-26 (AY 2026-27) Excel Download

Introduction Budget 2025 has completely reshaped how salaried taxpayers in India view Income Tax. With zero tax up to ₹12.75 lakh, countless middle-class families now breathe a sigh of relief. However, despite this welcome relief, taxpayers still struggle with Income Tax calculations, which often feel like solving a puzzle with missing pieces. Wouldn’t life be simpler if a personal assistant handled all the numbers for you? That’s exactly what the Income Tax Calculator All-in-One in Excel for FY 2025-26 delivers. Think of it as a digital tax buddy—you enter your…

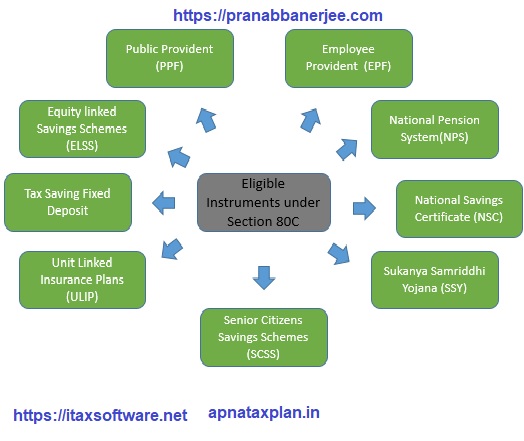

Top Tax-Saving Investment Options Under Income Tax Section 80C for the Old Tax Regimes

Do you want to save more taxes and grow your money at the same time? You’re not alone. Most investors look for ways to legally reduce their tax burden while still earning good returns. Luckily, Income Tax Section 80C for the Old Tax Regimes gives you a wide range of tax-saving investment options. But here’s the catch—not all of them work the same way. Some give better returns, others offer more safety. So, how do you pick the right one for your goals? Let’s simplify it. We’ll walk you through…

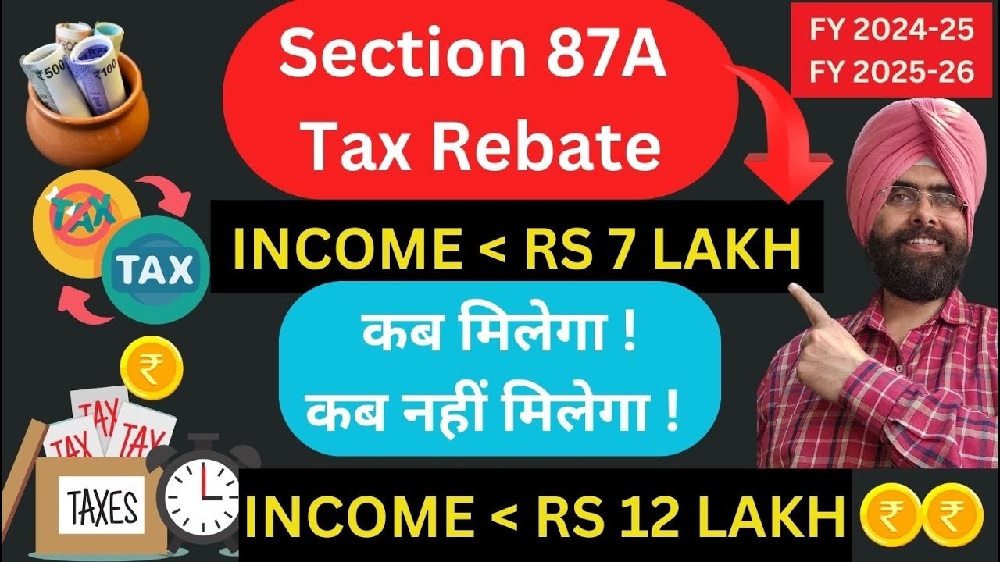

Section 87A Tax Rebate Allowed on STCG in New Tax Regime – Relief for Salaried Taxpayers

Introduction If you’ve been confused about whether the Section 87A tax rebate applies to short-term capital gains (STCG) under the new tax regime, you’re not alone. Many salaried taxpayers wondered if they could claim this rebate when their total income included gains taxed under Section 111A. Thankfully, two recent appellate rulings have brought much-needed clarity and relief. In simple terms, the Commissioners of Income Tax (Appeals) confirmed that taxpayers earning up to ₹7 lakh annually—including income from STCG—can still claim the Section 87A rebate under Section 115BAC(1A). Let’s dive deeper…

How to Save Income Tax in India 2025: A Guide for Taxpayers with an Automatic Income Tax Preparation Software in Excel All in One with Form 10E for the Govt & Non-Govt Employees for the F.Y.2025-26

Introduction Do you sometimes feel that income tax looks like a maze with endless turns and confusing dead ends? If so, you’re definitely not alone. In fact, many taxpayers, whether government employees or non-government employees, constantly struggle to understand how to save tax legally while still complying with all the rules. Fortunately, the good news is that with the right knowledge and an Automatic Income Tax Preparation Software in Excel All-in-One with Form 10E, you can easily transform tax filing into a smooth, simple, and hassle-free process for the financial…

Imagine the Income Tax: Why 90% or More Taxpayers May Shift from Old to New Regime as per Budget 2025

Introduction Imagine a world where filing income tax no longer feels like solving a complicated puzzle. That’s exactly the vision behind Budget 2025, where the government has reshaped tax slabs and increased exemptions, making the new tax regime more attractive than ever. With zero tax on income up to ₹12 lakh, a revised standard deduction, and simplified processes, the government expects over 90% of taxpayers to embrace the new system. But what does this mean for you? How will these changes impact taxpayers across different income groups? And why is…